Select an article below

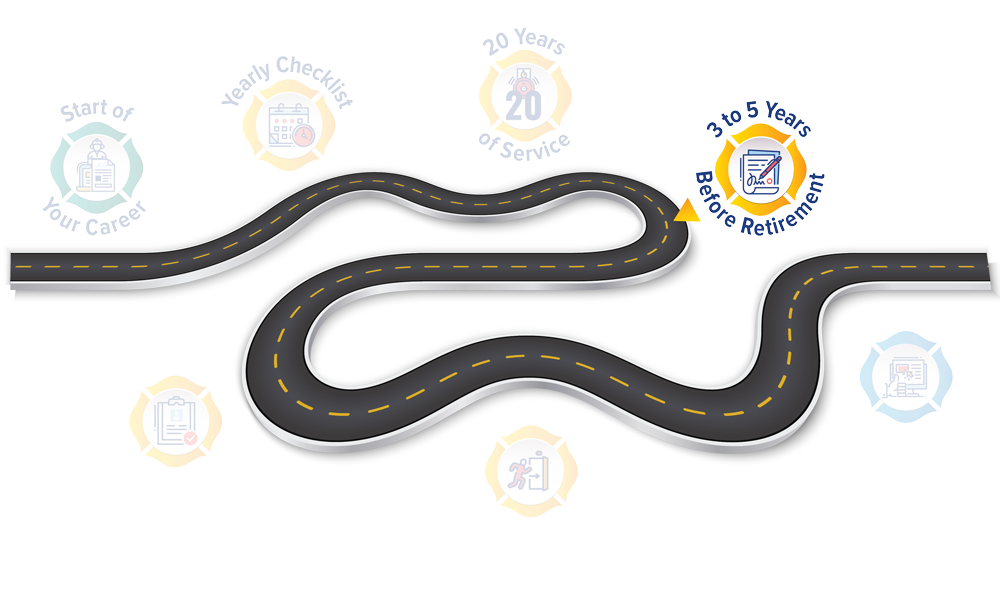

G. Three to Five Years Before Retirement

Deferred Compensation Plan (DCP) Review

Voya suggests that you consider the following issues three to five years before your retirement:

- Last Three-Year Catch-up: Only available for the three years before your declared retirement year. Your retirement year can be no earlier than the date you are eligible for a full, unreduced pension. Documentation from the Washington State Department of Retirement Systems (DRS) LEOFF 2 may be required. If you are participating in the Voya DCP, please email Stephen Gray at Purpose Financial () or call him at (509) 455-4010 for more information. If you’re participating in the DRS DCP, see the “Contributions and limits” section on the DRS DCP website for more information.

- Investment Diversity and Appropriate Level of Risks: Is your account allocation invested as you like? Are you comfortable with the level of risk?

- Beneficiary Designation: Review your beneficiary information on file with DRS and/or Voya. Make sure it remains current.

- Retirement Income Calculator/My Interactive Retirement Planner: Review your portfolio, including pension and social security income estimates. Make adjustments to your DCP as needed.

- Outstanding Loans: Make sure you understand the consequences of not paying off a plan loan by your retirement date. If you have taken a loan and fail to repay the balance, there are costs associated with the loan default. Here are some issues to consider when evaluating whether you want to take out/keep a DCP loan:

- The money you borrow will no longer be invested in the market, so you’ll lose potential market gains and/or earned interest.

- You’ll be repaying the loan with after-tax funds.

- You’ll incur loan fees when you take out a loan, as well as annual loan fees for every year the loan remains unpaid.

- If you take Leave, your DCP loan repayments stop since they are funded through payroll deductions, risking the loan going into default if you don’t make other arrangements for repaying it.

- Unused Sick Leave Conversion: Converting vacation and other accrued leaves may help you defer a larger-than-usual portion of your final year’s compensation into the plan. This may save you money on taxes. Plan ahead to maximize your ability to convert vacation and other accrued leaves.

Returning to Work: Your ability to take a withdrawal from the DCP may be affected if you return to work for the city. You must coordinate with the plan administrator if you intend to take withdrawals and return to work.